Introduction

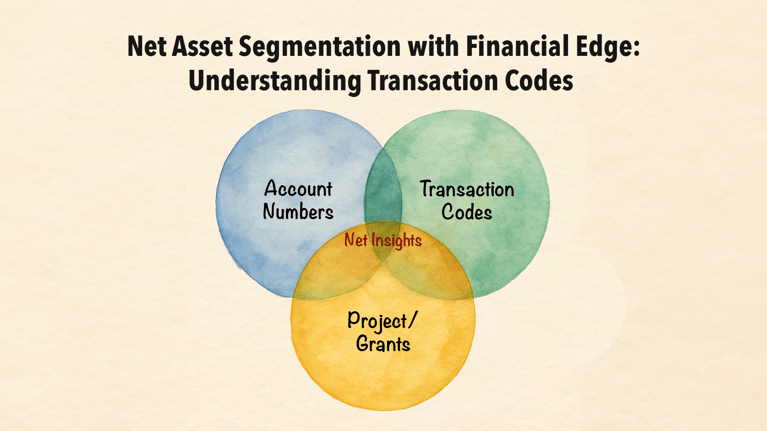

In the complex world of nonprofit accounting, the ability to view and analyze financial data

across multiple dimensions isn't just convenient—it's essential. Blackbaud's Financial Edge

differentiates itself from traditional accounting systems with its unique capability to segment net

assets into multiple layers or "dimensions," offering unprecedented clarity for nonprofit financial

management. While most accounting systems limit organizations to segmenting net assets solely

through components of the account number, Financial Edge expands this concept by enabling a

three-dimensional approach: Account Number, Project/Grant, and Transaction Code. This multidimensional net asset framework allows nonprofit organizations to simultaneously track GAAP-required net asset segmentation (such as with and without donor restrictions) alongside project or

grant-specific net assets—all without creating an unwieldy chart of accounts.

The Limitations of Traditional Accounting Systems

Most nonprofit accounting systems restrict organizations to a one-dimensional approach to net asset segmentation, relying solely on components of the account number structure. In this conventional framework, financial teams typically designate a portion of the account number— often a fund number—to distinguish between required GAAP segmentations such as with and without donor restrictions. While this approach functions at a basic level, it creates significant challenges as organizational complexity grows. The fundamental limitation becomes apparent when nonprofits need to track multiple types of segmentation simultaneously. For instance, when an organization needs to monitor both GAAP-required fund designations and specific project or grant balances, traditional systems force accountants to incorporate all these tracking needs into the account number itself. This inevitably leads to an exponential expansion of the chart of accounts, creating a cumbersome structure that becomes increasingly difficult to navigate, maintain, and reconcile.

The Three Dimensions of Net Assets with Financial Edge

Dimension 1: Account Numbers

The account number structure in Financial Edge serves as the foundational dimension of financial tracking, similar to traditional accounting systems. However, Financial Edge optimizes this approach by allowing organizations to create a streamlined chart of accounts focused on essential classifications. Typically, this dimension encompasses a fund number component that designates the required GAAP segmentation of net asset (with or without donor restrictions) and an account code that classifies the transactions (cash, accounts receivable, travel expense, etc.).

Dimension 2: Project/Grant Module

Financial Edge's second dimension introduces a powerful layer of segmentation through its Project/Grant module. This dimension works in conjunction with the chart of accounts but exists as a separate component from the account number structure. Each project or grant can be assigned a unique identifier, enabling organizations to track net asset associated with specific initiatives, programs, or funding sources. The Project/Grant module eliminates the need to create separate account numbers for each project, significantly reducing chart of accounts bloat. Organizations can maintain a concise account structure while still capturing detailed financial information at the project level.

Dimension 3: Transaction Codes

Transaction Codes represent Financial Edge's third dimension of financial tracking, further extending the system's capabilities for net asset segmentation. This feature allows organizations to add yet another layer of classification to each transaction without expanding the chart of accounts or complicating the project structure. Financial Edge supports up to five different types of transaction codes, each with numerous possible values, providing extraordinary flexibility in financial tracking. What makes Transaction Codes particularly powerful is their persistence within the system. When coded to transactions, this segmentation becomes a permanent part of the accounting data, preserved even after fiscal periods close. For organizations previously relying on Excel spreadsheets to track complex net asset segmentation, Transaction Codes offer a systematic, integrated alternative that maintains data integrity throughout the accounting lifecycle.

Conclusion

For nonprofit financial professionals seeking greater transparency, compliance, and reporting capabilities, understanding and leveraging Financial Edge's three-dimensional net asset structure represents a significant step toward more sophisticated financial management. By implementing Account Numbers, Projects/Grants, and Transaction Codes appropriately, organizations can achieve unprecedented clarity and flexibility in their financial tracking and reporting